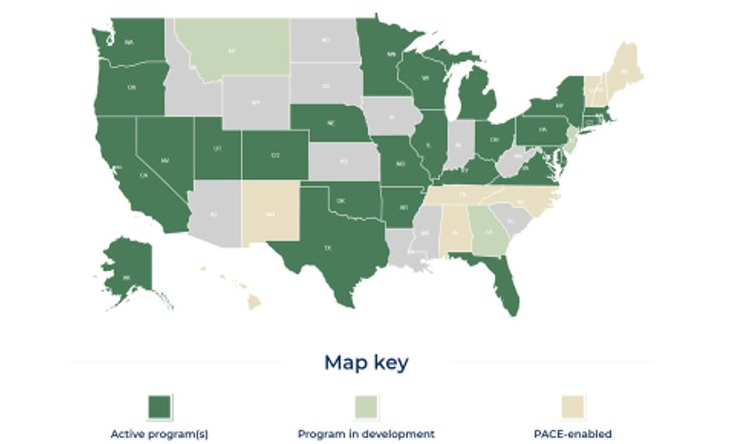

While Commercial PACE Financing dates back to 2008, the growth in the market in recent years is significant, now seeing over $3B in deal flow nationwide. The availability of PACE financing now covers more than 80% of the US population.

PACE: Property Assessed Clean Energy

- PACE is an assessment-based financing solution for clean energy projects; projects can be new construction, tenant improvement, or retrofit.

- Eligible building improvements include solar, roofing, lighting, HVAC, insulation, plumbing, elevators, and related soft costs.

- Non-recourse, long-term (up to 30 yrs), fixed-rate financing as low as 4.75%.

- 100% financing solution, no ash requirement.

- Can be considered a form of equity and not carried as balance sheet debt.

- Transferrable upon sales of property and can be passed through lease structures to tenants.

PACE financing (property assessed clean energy financing) is a means used in the United States of America of financing energy efficiency upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations of residential, commercial, and industrial property owners. Depending on state legislation, PACE financing can be used to finance building envelope energy efficiency improvements such as insulation and air sealing, cool roofs, water efficiency products, seismic retrofits, and hurricane preparedness measures. In some states, commercial PACE financing can also fund a portion of new construction projects, as long as the building owner agrees to build the new structure to exceed the local energy code.

Examples of energy efficiency and renewable energy upgrades range from adding more attic insulation to installing rooftop solar panels for residential projects and chillers, boilers, LED lighting and roofing for commercial projects. In areas with PACE legislation in place, governments offer a specific bond to investors or in the case of the open-market model, private lenders provide financing to the building owners to put towards an energy retrofit. The loans are repaid over the selected term (over the course of somewhere between 5 and 25 years) via an annual assessment on their property tax bill. PACE bonds can be issued by municipal financing districts, state agencies or finance companies and the proceeds can be used to retrofit both commercial and residential properties. One of the most notable characteristics of PACE programs is that the loan is attached to the property rather than an individual.[1][2][3][4] A PACE loan is therefore said to be nonrecourse to the borrower.[5]

PACE can also be used to finance leases and power purchase agreements (PPAs). In this structure, the PACE property tax assessment is used to collect a lease payment of services fee. The primary benefit of this approach is that project costs may be lower due to the provider retaining the tax incentives and passing the benefit on to the property owner as a lower lease or services payment.